Ramp valuation refers to the market value assigned to Ramp, the fast-growing corporate card and spend management platform. In the world of startups, valuation isn’t just a number—it’s a signal of confidence, growth, and future potential. For Ramp, recent funding rounds have pushed its valuation into the multi-billion-dollar range, making it one of the most closely watched fintech unicorns in the U.S.

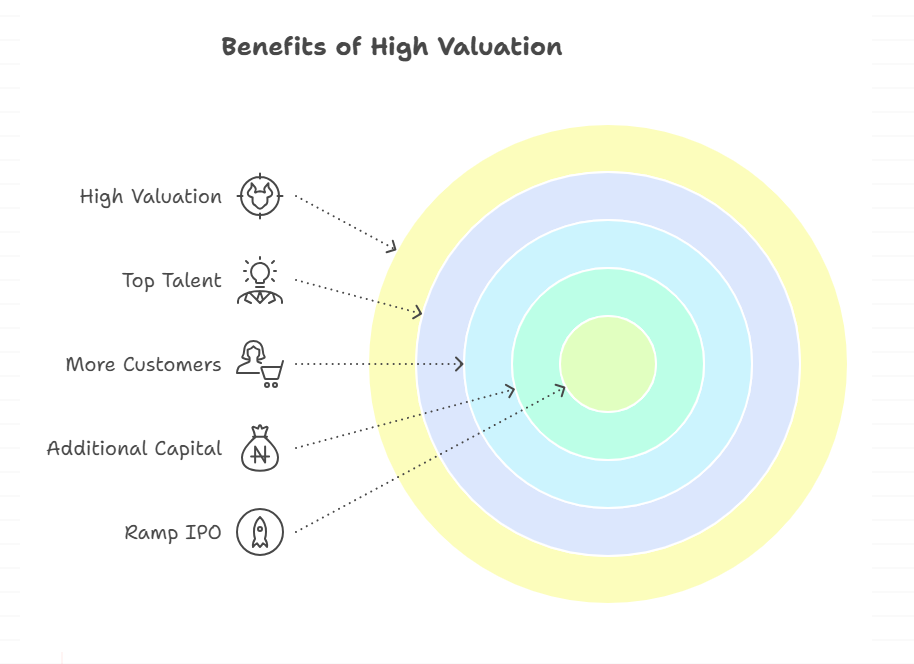

But why does this matter? For one, a high valuation can attract top talent, more customers, and additional capital. It also sets the stage for a possible Ramp IPO, which could reshape the competitive landscape for expense management and corporate cards.

The Rise of Ramp: From Startup to Fintech Powerhouse

The Early Days: Solving Real Problems

Ramp launched in 2019 with a simple mission: help businesses save money and streamline their spending. The founders, who previously built and sold Paribus to Capital One, saw firsthand how inefficient expense management could be. They set out to build a smarter, more automated solution.

Ramp Platform: The Engine Behind the Growth

At the heart of Ramp’s success is the Ramp platform—a cloud-based system that combines corporate cards, expense tracking, and real-time analytics. Unlike traditional solutions, Ramp uses AI to flag wasteful spending, automate approvals, and integrate seamlessly with accounting software.

One user shared, “Switching to Ramp cut our monthly expense processing time in half. The insights we get from the platform are a game-changer for our finance team.”

Ramp Cards: More Than Just Plastic

The Ramp cards are physical and virtual corporate cards that offer real-time controls, customizable limits, and automatic receipt matching. For finance teams, this means less manual work and fewer headaches. For employees, it means faster reimbursements and fewer out-of-pocket expenses.

Breaking Down Ramp Valuation: The Numbers and the Drivers

Funding Rounds and Investor Confidence

Ramp’s valuation has soared with each funding round. In 2021, the company was valued at $1.6 billion. By 2023, that number had jumped to over $8 billion, thanks to investments from heavyweights like Founders Fund, Stripe, and Coatue.

What’s driving this confidence? Investors see Ramp as a category leader in a massive, underserved market. The company’s rapid revenue growth, high customer retention, and innovative product roadmap all contribute to its sky-high valuation.

Ramp’s revenue has reportedly tripled year-over-year, with thousands of businesses—from startups to Fortune 500s—using the platform. The company’s focus on automation and savings has helped it win market share from legacy players like American Express and Expensify.

The Role of Ramp Capital

In 2022, Ramp launched Ramp Capital, a suite of financial products designed to help businesses access credit, manage cash flow, and optimize working capital. This move expanded Ramp’s addressable market and added new revenue streams, further boosting its valuation.

How Ramp Stacks Up Against the Competition

Ramp vs. Brex vs. Expensify

The spend management space is crowded, but Ramp has carved out a unique position. While Brex targets startups and Expensify focuses on expense reporting, Ramp offers a full-stack solution that appeals to a broader range of businesses.

- Ramp Platform: End-to-end automation, deep integrations, and real-time insights.

- Ramp Cards: Instant issuance, customizable controls, and no hidden fees.

- Ramp Capital: Flexible credit lines and working capital solutions.

User Experience: What Customers Are Saying

Ramp’s user reviews consistently highlight the platform’s ease of use, transparency, and customer support. One finance manager tweeted, “Ramp’s automation features have saved us countless hours. I can’t imagine going back to our old system.”

The Road to Ramp IPO: What’s Next?

Signs Pointing to a Public Offering

With its soaring valuation and strong financials, many analysts believe a Ramp IPO is on the horizon. The company has reportedly hired experienced CFOs and legal advisors, fueling speculation about a public debut in late 2025 or early 2026.

Risks and Considerations

Of course, no investment is without risk. Ramp faces intense competition, regulatory scrutiny, and the challenge of maintaining rapid growth as it scales. Potential investors should keep an eye on customer acquisition costs, churn rates, and the broader economic climate.

The Pros and Cons of Ramp Valuation

Pros

- Strong Growth Trajectory: Ramp’s revenue and customer base are expanding rapidly.

- Innovative Product Suite: The combination of Ramp cards, platform, and capital solutions sets it apart.

- High Customer Satisfaction: Positive reviews and high retention rates signal a sticky product.

- IPO Potential: A public offering could unlock even more value for early investors.

Cons

- High Expectations: A lofty valuation means Ramp must continue to deliver outsized growth.

- Competitive Market: Rivals like Brex, Airbase, and legacy banks are not standing still.

- Regulatory Risks: As Ramp expands into lending and capital markets, compliance becomes more complex.

- Economic Uncertainty: Macroeconomic shifts could impact spending and credit demand.

Features and Usability of Ramp in 2025

Seamless Integrations

Ramp integrates with popular accounting platforms like QuickBooks, Xero, and NetSuite. This makes it easy for finance teams to sync transactions, automate reconciliations, and close the books faster.

AI-Powered Insights

The platform’s AI engine analyzes spending patterns, flags anomalies, and suggests cost-saving opportunities. In 2025, these features have only gotten smarter, helping businesses make data-driven decisions in real time.

Mobile-First Experience

With a robust mobile app, employees can submit expenses, manage cards, and track approvals on the go. This flexibility is a major selling point for remote and hybrid teams.

Security and Compliance

Ramp uses bank-level encryption, multi-factor authentication, and real-time fraud monitoring to keep data safe. The platform is also SOC 2 Type II certified, meeting the highest standards for security and compliance.

Real-World Example: How Ramp Helped a Growing Startup

Let’s look at a real-life scenario. A fast-growing SaaS company switched to Ramp after struggling with manual expense reports and delayed reimbursements. Within three months, they reduced processing time by 60%, saved over $20,000 in unnecessary spend, and improved employee satisfaction.

The CFO shared, “Ramp’s automation and transparency have transformed our finance operations. We’re able to focus on growth instead of paperwork.”

The Future of Ramp Valuation: What to Watch

Expansion into New Markets

Ramp is eyeing international expansion, with plans to launch in Europe and Asia. This could open up massive new markets and further boost its valuation.

Product Innovation

Expect to see more AI-driven features, deeper integrations, and new financial products from Ramp Capital. The company’s focus on R&D is a key driver of its long-term value.

M&A Activity

As Ramp grows, it may look to acquire complementary startups or partner with banks and fintechs. These moves could accelerate growth and enhance the platform’s capabilities.

FAQs

1. How is Ramp valuation determined?

Ramp valuation is based on factors like revenue growth, customer base, market opportunity, and investor demand. Recent funding rounds and comparisons to similar fintech companies also play a role.

2. What makes Ramp cards different from traditional corporate cards?

Ramp cards offer real-time controls, instant issuance, and automated expense tracking. Unlike traditional cards, they integrate seamlessly with the Ramp platform and provide detailed analytics.

3. Is Ramp planning an IPO soon?

While Ramp hasn’t officially announced an IPO, industry insiders expect a public offering in the next 12–18 months, given the company’s growth and recent executive hires.

4. What are the risks of investing in Ramp?

Risks include intense competition, regulatory challenges, and the need to sustain rapid growth. As with any high-growth startup, there’s also the risk of overvaluation if market conditions change.

Final Thoughts

Ramp’s valuation reflects its rapid growth, innovative product suite, and strong market position. While the numbers are impressive, the real story is in the platform’s ability to solve real-world problems for businesses of all sizes. As Ramp continues to expand and innovate, its valuation will remain a key metric to watch—especially as a potential IPO looms.

CLICK HERE FOR MORE BLOG POSTS

Liam is a freelance writer, blogger, and digital media journalist. He has a management degree in Supply Chain & Operations Management and Marketing and boasts a wide-ranging background in digital media.