Ownership cost is the full financial burden of buying and maintaining something over its usable life. It’s not just the sticker price it’s everything you pay to use, maintain, protect, and eventually replace or dispose of an asset.

Let’s break it down practically:

Ownership Cost =

Upfront Cost + Maintenance + Repairs + Insurance + Utilities or Operational Fees + Taxes + Depreciation

Why Most People Underestimate the True Cost of Ownership

Buying something is easy. Owning it? That’s where the hidden surprises come in.

Take cars, for instance. On the surface, a €20,000 sedan looks like a steal. But factor in auto insurance in Germany, regular servicing, gas, Umweltplakette (environmental sticker), toll tags, and German TÜV certification—and suddenly the real TCO (Total Cost Ownership) doubles.

And it’s not just cars.

- Homeownership? Watch out for hidden property taxes, renovation fees, and heating bills.

- Software licenses? You’ll be paying for scaling, updates, storage, and user support.

- Even pets—yes, sweet Bruno the Beagle has an ownership cost.

TCO vs Ownership Cost: Are They the Same?

It depends on who you ask.

Technically, TCO (Total Cost of Ownership) is a financial term used by businesses to predict the full lifecycle cost of an asset. But in everyday use, “ownership cost” and “TCO cost” get used interchangeably.

Still, here’s a helpful difference:

| Term | Used Mostly By | Focus | Includes… |

|---|---|---|---|

| Ownership Cost | Consumers | Practical expense tracking | All costs related to owning personal assets like cars, homes, or gadgets |

| TCO (Total Cost Ownership) | Businesses & Analysts | Lifecycle financial planning | Cost over time: purchase, operation, upgrades, downtime, disposal |

Pro tip in 2025: Both matter. Whether you’re buying a Tesla or implementing Microsoft Azure in your company, missing hidden costs hurts.

🇩🇪 Real Talk: Ownership Cost When You Move Your Car to Germany

Let’s say you’re relocating for work, and plan to bring your car to Germany from the US or the UK.

Here’s a small reality check:

“Shipping my car to Germany cost less than €2,500. But between customs duty, TÜV inspection, emissions check, mods for compliance, and registering again—it ended up costing an extra €5,000 over the first year.”

Yup. Ownership cost just became your nemesis.

In 2025, moving a vehicle internationally means factoring in:

- Import duties

- Registration (Zulassungsstelle fees)

- Required modifications for local compliance

- Auto insurance Germany standards (could be 3x what you’re used to)

- Potential social/eco taxes for older petrol vehicles

- Parking permits in cities

Lifetime tip: Always calculate the TCO cost for vehicles, especially across borders.

Ownership Cost in the Subscription Economy (Yes, It’s Still an Issue)

You might think switching everything to subscriptions eliminates ownership worries. In theory, yes. In reality?

Not so much.

Let’s compare:

| Asset/Service | Monthly Plan | Hidden Ownership Costs |

|---|---|---|

| Car leasing | €599/month | Per-kilometer overage, damage fees, maintenance still yours |

| SaaS software | €75/user/month | Storage fees, onboarding costs, mandatory upgrades |

| Smart home setup | €10/device/month | Installation, energy costs, dependency on firmware |

So even in the age of “I don’t own it—I subscribe,” ownership cost is quietly trailing you.

Hidden Factors That Raise Ownership Costs in 2025 (That No One Talks About)

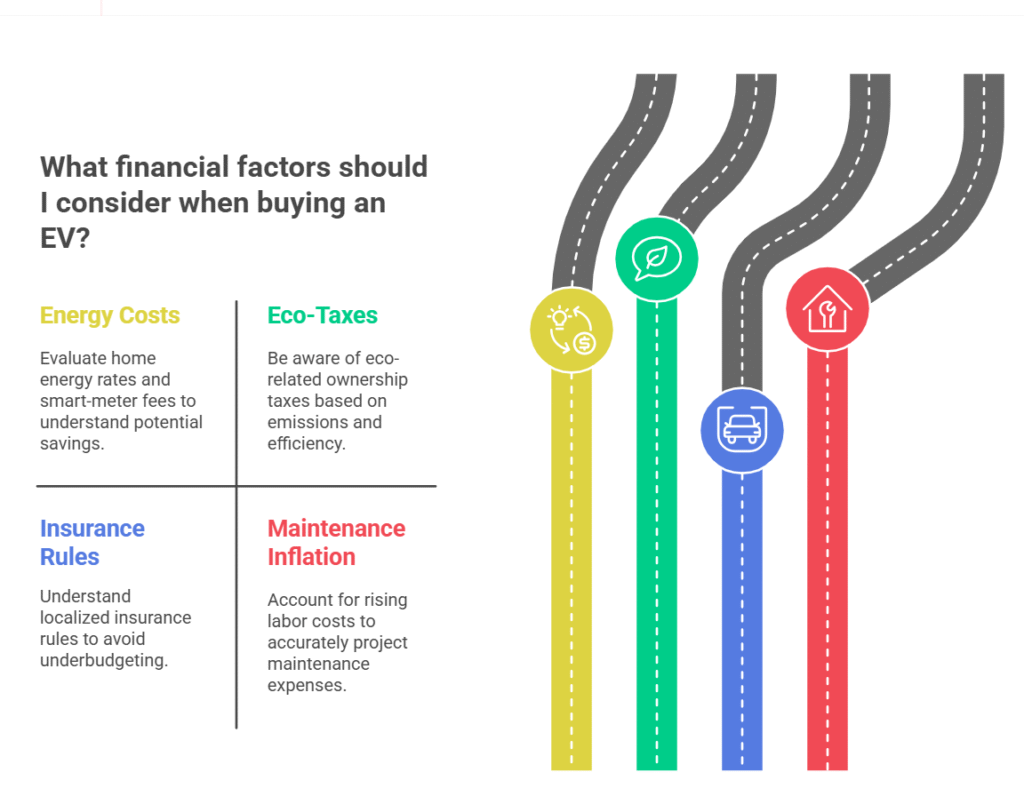

- Energy costs

Electric vehicles may save you on gas, but pay attention to home energy rates and smart-meter fees. - Eco-taxes

Germany and other EU countries now charge eco-related ownership taxes based on emissions, energy efficiency, and product origin. - Localized insurance rules

If you calculate auto insurance in Germany the way it works in the US or UK, you will underbudget. - Maintenance inflation

Labor costs have risen sharply post-2023. Small repairs, especially in homes and vehicles, can now double your initial projections.

Deep Dive: How to Calculate Your TCO (Total Cost of Ownership)

Thinking like a CFO (even for your personal life) pays dividends.

Here’s a sample framework to properly compute TCO cost in 2025:

Step 1 — Acquisition Cost

- Initial payment

- Taxes & interest (if financed)

Step 2 — Operational Costs

- Fuel, electricity, or subscription

- Maintenance and servicing

- Insurance premiums

- Licensing & upgrades

Step 3 — Indirect Costs

- Downtime or productivity loss

- Learning curve & training

- Time cost for usage or repair

Step 4 — End-of-Life Costs

- Resale value or disposal cost

- Renewal costs

Pro Tip: Use a spreadsheet or templates from apps like Notion or YNAB to track these. Set reminders for long-term costs like replacements or maintenance milestones.

Real User Quote: TCO & Personal Finances

“Tracking TCO for our family van changed how we shop now. We skipped the SUV, bought a hybrid hatchback, and saved €4,200 in just two years on fuel and maintenance. I wish I had done this 5 years ago.”

Calculating Ownership Cost of Cars vs Electric Vs Lease (2025 edition)

| Element | Petrol Car | EV Purchase | EV Lease |

|---|---|---|---|

| Purchase Price | €25,000 | €33,000 | €0 |

| Energy/Fuel | €1,800/yr | €900/yr | €900/yr |

| Insurance (Germany) | €1,200/yr | €1,400/yr | Often rolled in |

| Maintenance | €800/yr | €300/yr | €0 (included) |

| Resale / Buyout | €7,000 after 5 years | €15,000 | €0 |

FAQs

Q. What is included in ownership cost?

A. Ownership cost includes all expenses accrued from the time you purchase an asset until you dispose of it: purchase price, insurance, taxes, fuel, maintenance, depreciation, and in some cases, opportunity cost.

Q. What is TCO and why is it important?

A. TCO (Total Cost Ownership) is a comprehensive financial estimate designed to help buyers (individuals or businesses) understand all direct and indirect costs of an asset over its lifecycle. It helps in avoiding costly surprises and making data-backed decisions.

Q. How much does it cost to own a car in Germany in 2025?

A. The TCO cost of owning a car in Germany varies widely. Average estimates:

Compact petrol: €6,000–€8,000/year

EV: €4,500–€7,000/year depending on insurance, energy bills, and tax class

Always check auto insurance Germany calculators that factor your vehicle, city, and driving history.

Q. Is leasing better than owning in 2025?

A. It can be! For short-term usage, low mileage, and new tech (like EVs), leasing often beats the traditional model. But if you drive a lot, take care of your vehicle, and intend to own it over 7 years—buying is still cheaper in the long run, factoring in the TCO

Conclusion

In 2025, you can’t afford to overlook what things actually cost to own. With inflation pushing prices and environmental laws reshaping what “value” really means, looking only at sticker prices can ruin budgets fast.

CLICK HERE FOR MORE BLOG POSTS

John Authers is a seasoned and respected writer whose work reflects the tone, clarity, and emotional intelligence that readers value in 2025. His writing blends deep insight with a natural, human voice—making complex ideas feel relatable and engaging. Every piece he crafts feels thoughtful, original, and genuinely worth reading.